Our Market Operations Weekly Report contains the latest information about the electricity market, including security of supply, wholesale price trends and system capacity.

It is published every Tuesday. Click here to receive the report via email every week.

If you have any comments or questions please contact the Market Operations Team at [email protected].

Latest Report / More Information

|

|

Current Storage Positions

Overview

New Zealand hydro storage has decreased from 113% to 112% of the historic mean for this time of year, while renewable generation remained high last week at 95% of the weekly generation mix.

This week’s insight looks at Standby Residual Check notices and why some were sent to market participants last week.

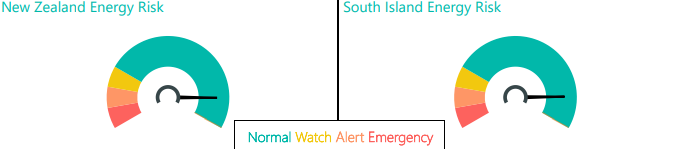

Security of Supply and Capacity

Energy

National hydro storage has decreased to 112% of the seasonal mean at the end of last week. South Island hydro storage decreased from 107% to 105% of the historic mean, and North Island storage increased from 177% to 180%.

Capacity

Residuals were healthy with the lowest residual of 938 MW occurring during the morning of Friday 27 February.

The N-1-G margins in the NZGB forecast are healthy through to the end of April. Within seven days we monitor these more closely through the market schedules. The latest NZGB report is available on the NZGB website.

Electricity Market Commentary

Weekly Demand

Total demand last week increased from 714 GWh to 726 GWh for the week, and is in line with average demand at this time of year over the past three years. The highest demand peak of 5,170 MW occurred at 5:30pm on Thursday 26 February.

Weekly Prices

The average wholesale electricity spot price at Ōtāhuhu last week was $84/MWh, increasing from $47/MWh the week prior. Wholesale prices peaked at $226/MWh at Ōtāhuhu at 7:00am on Friday 27 February. Some periods of price separation between the North and South Islands were observed throughout the week as HVDC transfer was limited due to the annual outage. The greatest period of price separation occurred on 12:30 pm on Tuesday 24 February where the wholesale price peaked at $141.45/MWh at Ōtāhuhu.

Generation Mix

Wind generation decreased its share of the mix from 10% to 8% of the mix. Hydro generation increased to 58% of the mix, from 56% the week prior. Thermal generation increased to 4% of the mix from 2% the week prior, thereby ending the 20th consecutive week streak of 96% total renewable generation. The geothermal share remained at 26% of the mix, and solar contributed to 1% of the generation mix.

HVDC

HVDC flow last week was predominantly northward with the exception of some brief periods of overnight low southward flow. These periods coincided with periods of high wind generation and lower North Island demand. In total, 26 GWh was transferred north and just 5 GWh was transferred south.

New additions to our Weekly Report

Our team has worked to add more data to our insights to now include:

• BESS generation

• OTA2201 Rolling average price chart

• Price Separation rolling average price chart

• A different view of hydro storage statistics