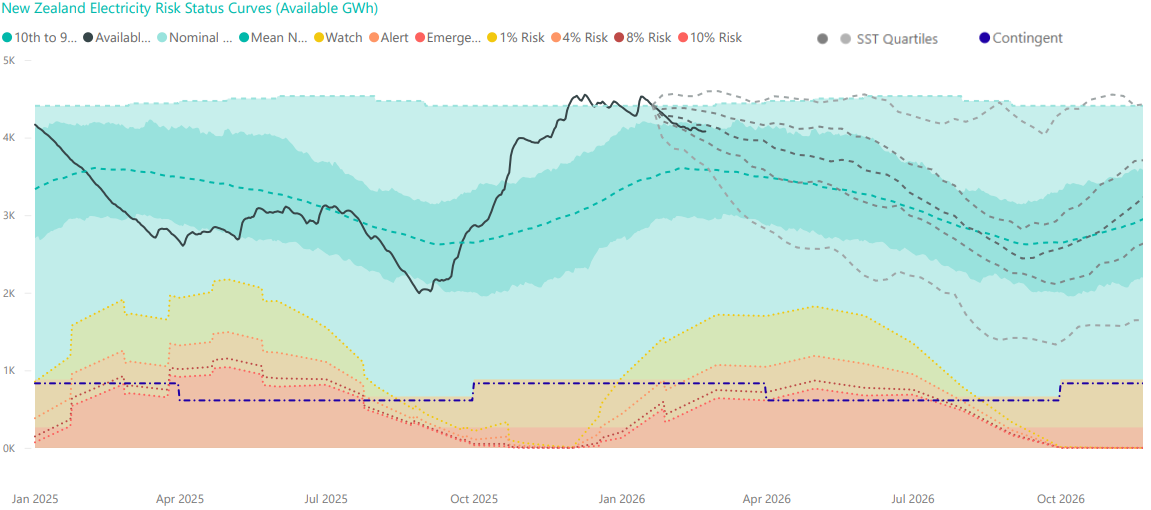

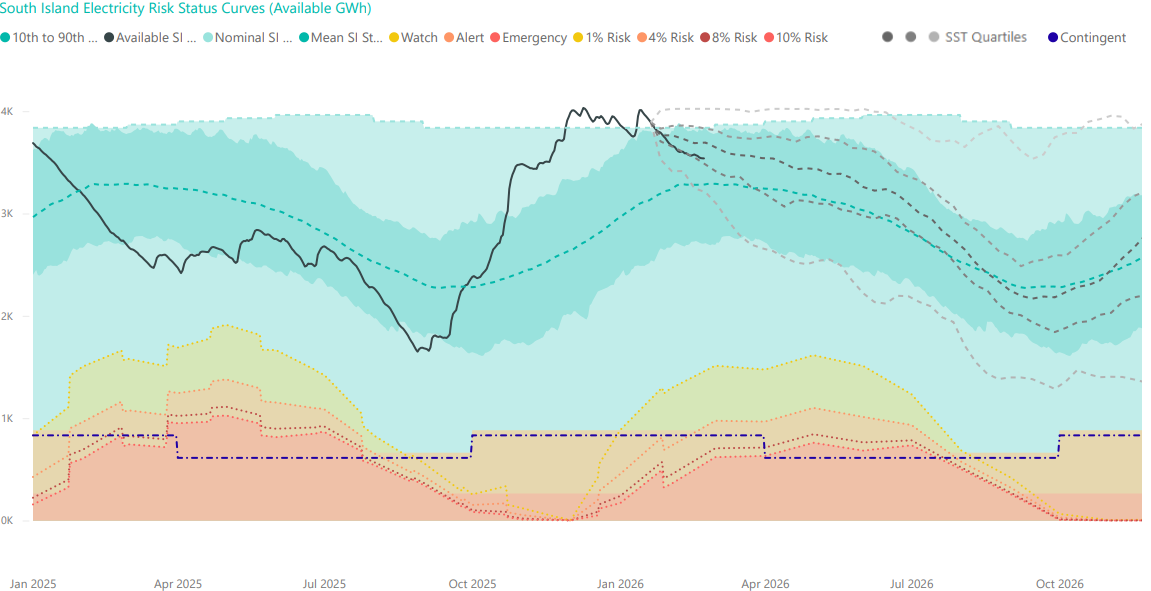

The Energy Security Outlook (ESO) is a monthly report that helps track how secure New Zealand’s electricity supply might be over the next two years. It uses two key tools, the Electricity Risk Curves (ERCs) and Simulated Storage Trajectories (SSTs), to show how likely it is that we’ll have enough electricity, especially during dry periods when hydro lakes are low.

For more information on how it works and why it matters, we have published an 'ESO 101' document that covers how ERCs and SSTs help forecast electricity risks, what triggers action when supply looks tight, and how extra hydro storage can be used if needed.

February 2026 Energy Security Outlook

- The national controlled hydro storage position remains high, but has fallen to 113% of the historic mean at 24 February. South Island storage is at 107%.

- The risk curves in this update are very similar to the January update, with small changes driven mostly by changes to outages and modelled commissioning dates.

- No Simulated Storage Trajectories (SSTs) cross the Watch curve in 2026 or in 2027. This assumes the market supplements the existing coal stockpile at its maximum import capability to maintain increased thermal generation during any extended periods of low hydro inflows.

- As we approach winter and spring 2026, an ongoing focus on hydro storage management and ensuring sufficient backup thermal fuels and capacity remains necessary to mitigate the potential for very high prices.

- Current levels of thermal storage (gas and coal) remain close to their maximum levels.

The graphs below compare New Zealand and South Island controlled storage to the relevant Electricity Risk Status Curves.

Image

Image

Related Files

Energy Security Outlook Data Files

Assumptions and Update Logs

- Scenarios

- Historic Logs